Autumn Statement 17 Nov 2022

The headline tax rises the Chancellor announced in his Autumn Statement to Parliament on 17 Nov 2022

The headline tax rises the Chancellor announced in his Autumn Statement to Parliament on 17 Nov 2022

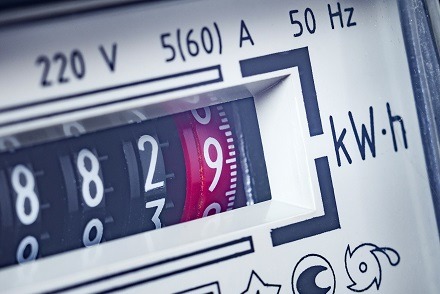

A recap of the Energy Bill Relief Scheme, making it clear that the discount only applies to the wholesale element of a business’ energy costs.

Craig Simpson, Tax Partner at Bates Weston looks at the growing trend towards employee Ownership and the Employee Ownership Trust in particular.

In Jeremy Hunt’s statement yesterday, he told us which Mini-Budget measures are staying and which are not going ahead. The summary is simple. Everything goes except abolishing the Health & Social Care Levy, changes to Stamp Duty and the increased Annual Investment Allowance.

How keen is the UK, in general, to embrace HMRC’s Making Tax Digital (MTD) initiative? Are we lagging behind other countries in adopting a digital system and have we gone far enough to digitise all business processes, rather than just the integration with the tax system?