Tax planning and asset protection

In a time of economic uncertainty, thoughts turn to asset protection – protecting business assets should your business suffer and passing on personal assets to future generations.

In a time of economic uncertainty, thoughts turn to asset protection – protecting business assets should your business suffer and passing on personal assets to future generations.

In the third in our series of company tax planning articles, Cassandra Graham, Senior Tax Manager at Bates Weston looks at the use of merger, demerger and reorganisation as a tax planning tool.

Amendments to the Finance Bill include treating coronavirus payments as taxable income, not disadvantaging those who came out of retirement or usually work abroad to help in the pandemic, treating Covid-19 as an exceptional circumstance for higher rate SDLT reclaims and encouraging Future Fund investors.

Company tax planning can be useful to recover cash from HMRC or to reduce the amount of tax you are expected to pay – both valuable outcomes in managing your cash flow position.

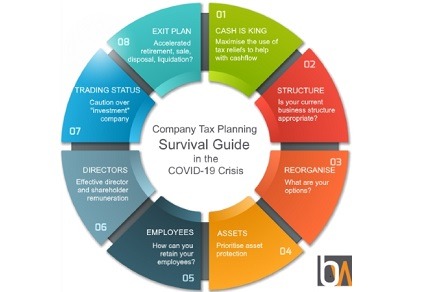

Our tax team have prepared a Bates Weston Company Tax Planning Guide to help you and your business get through the Covid-19 crisis and emerge, ready to respond to the challenges ahead.