Trading and property allowances

If your property income is less than £1,000 there is probably no need to report it to HMRC. There are exceptions and Graham Buckell takes us through the traps. “In the Budget 2016 the Chancellor announced two new exemptions for casual trading and property...R & D tax relief under-claimed

R&D tax relief still under-claimed Every year HMRC publish statistics about the take-up of the very generous Research & Development tax credit regime and this year’s review has yet again illustrated that the relief is often underclaimed. It seems that many...

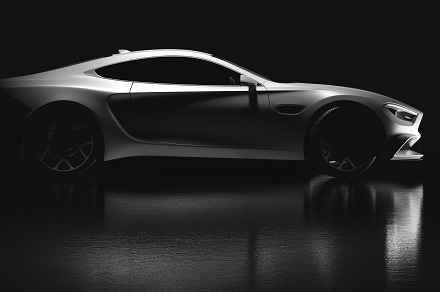

HMRC’s definition of a car

The difference between a company car and a van is not just aesthetic or practical, it has an impact on your tax bill.