BW Insight – Business Advisory

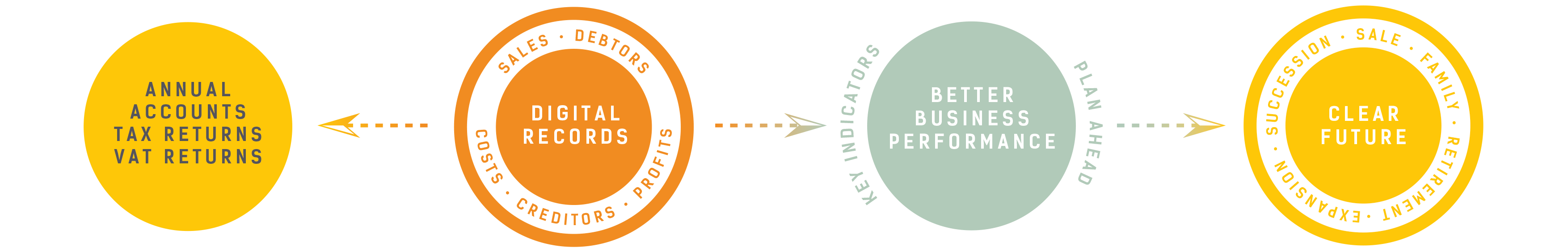

Our business advisory service, delivers real time advice based on real time information.

We work with you to focus on the key numbers for your business. We look at them in real time and use our insight to provide regular practical advice you can act on right away. Advice that gives you firm financial control, lets you take confident business decisions, and drives business improvement.

With oversight of your digital business records and regular communication, we work together to improve cashflow management, evaluate finance options, consider funding opportunities, provide forecasts and analyse budgets. Better business performance is the goal.

Insight is tailored to you. It is dependent on the management information you need and how often you would like us to provide, analyse and review it with you, but as a guide, we offer three service levels, FOCUS, ENHANCE and VISION. The services are outlined below and our policy on costs is straightforward. We will be clear from the outset what your service includes and its monthly cost.

Talk to us today, without obligation or cost, about improving your business performance.

Call 01332 365855 email BWInsight@batesweston.co.uk

Focus

We work together to highlight the key numbers for your business. Those that show its financial health, flag problems ahead or identify tax planning opportunities. We produce detailed and reconciled management information in a monthly or quarterly FOCUS report.

Enhance

We will analyse your FOCUS reports, and discuss them with you in person in a quarterly or monthly meeting whichever you prefer. We will explain what your numbers mean and what actions can be taken to improve your business performance.

Vision

Add forecasting your future position to the ENHANCE service to consider “what if” scenarios and understand the financial impact of decisions before you take them. We will compare actual results to forecasts too, to highlight unexpected costs and business performance, giving a vital heads up.

Plan Ahead

With your business performance secure, we encourage you to looking to your future. Talk to our specialist tax, corporate finance and pensions and investment teams about expansion, succession, structure, retirement and building and protecting your wealth for your dependents.

Related blogs

Bates Weston Summer Newsletter

Read our Summer newsletter, covering topical tax and regulatory changes and proposals, including the impact of recent tax changes on profit withdrawal plans

Sponsors meet U15 football squad members

Bates Weston had the opportunity to meet Grace and Olivia, players in the U15 football squad they sponsor this week. The U15s are one of 9 youth teams on the Derby County Community Trust Female Talent Pathway.

A New Partner at Bates Weston

The Bates Weston Partners are pleased to announce that Sean Douglass has become a Partner in the firm.

Promotion news from Bates Weston

Bates Weston is delighted to announce the promotion of Hannah Stevenson and Nathan Birks from qualified Senior Accountants to Assistant Relationship Managers.

Graduate Trainee Accountants

Our Graduate Trainee Accountant programme is now open. If you are graduating in 2024 and are interested in becoming a qualified Chartered Accountant, take a look at our website and apply now.

Changes in the way taxable business profits are calculated

If you are a sole trader or partnership and your accounting year end is not 31 March or 5 April, you are going to be affected by a change in the way taxable business profits are calculated for a tax year.

Get in touch

Let’s get things moving. Talk to us today.