Company tax planning is vital when choosing a business structure. Cassandra Graham, Senior Tax Manager at Bates Weston considers its rising importance at this time.

“The pandemic has had huge economic consequences alongside potentially long-term changes in business operating methods and consumer behaviour patterns. Businesses need to be swift to recognise the opportunities these changes present or mitigate the risks they may be exposed to.

In these circumstances, business owners should use the opportunity to review their business structure. For example, to consider which parts of your business or assets may be at risk and whether there are advantages to splitting up your company, separating a higher risk business from those that are performing well or separating the investment activities away from the trade.

If your business is one that is benefitting from present trading conditions, perhaps now is the time to consider an acquisition or expansion? Or if performance has been hit, it may be necessary to consolidate your core activities and assets and dispose of any deemed to be non-essential?

The structure you choose for your business going forward is crucial. It can help you to be responsive to market changes and to protect your assets. But it has to be done carefully, involving expert tax advice to avoid triggering unexpected tax liabilities. Don’t act in haste and make changes to your business structure without thinking about the immediate and long-term tax implications.”

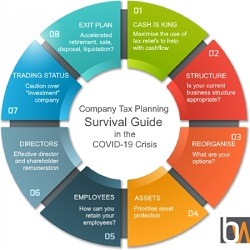

As specialist tax advisors, Bates Weston has produced a Company Tax Planning Survival Guide which considers 8 key aspects of tax planning that could help businesses get through the Covid-19 crisis. The business structure measures included are:

- Hive Ups and Hive Downs: The use of subsidiaries, holding companies and group structures to protect assets tax efficiently and to move trade and assets within a group structure without triggering tax. This will enable asset and/or business separation without setting up a separate new company outside of the group and triggering a dry tax charge on the transfer at market value without receiving any proceeds to fund the tax.

- Acquisitions: Performance in certain sectors has also boomed providing expansion and acquisition opportunities. When considering acquisitions, it is necessary to consider whether you have outlived your current structure and if a group structure is more appropriate. For example, any acquisitions of property could be achieved through a holding company where it could be acquired away from the trading activities. Furthermore, the tax implications of whether the trade and assets or alternatively the shares in a company should be acquired are also critical to the decision-making process.

- Disposals: The tax consequences of the structure of disposals are also key and should never be overlooked. There are often multiple ways to structure a disposal, some of which are more tax efficient than others.

We encourage you to speak with our tax team to make sure your structure is fit for purpose, tax efficient and to make sure any changes are implemented without surprise or unnecessary tax charges.

If you would like to discuss your business structure or any other aspect of our Tax Planning Guide, please do get in touch with in touch with Cassandra Graham, Craig Simpson or Richard Coombs.

Disclaimer: The information contained in this article is generic in nature. You should take no action based upon it without consulting ourselves or an alternative professional advisor. All information correct at time of publication: 18 June 2020