Richard Coombs, Tax Partner at Bates Weston, takes a look at Inheritance Tax Planning and the benefits of an Inheritance Tax Review – a topic no one likes to think about, but we really should.

Is your Inheritance Tax (IHT) planning up to date?

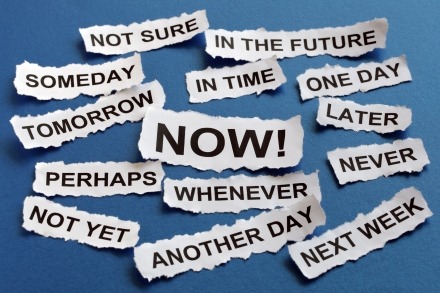

As all proud procrastinators will attest to, IHT planning is a long way down the list when it comes to financial planning. Quite understandably, no one thinks it is their time to die just yet and so they intend to “do it later”.

Whilst it is probably true to say that most us are statistically unlikely to die any time soon, the fact is that the longer IHT planning is left the more difficult it is to deal with. Assets tend to grow in value and therefore the inheritance problem just gets bigger. Whilst some might say a large estate is a nice problem to have, it is nevertheless an issue that needs to be looked at.

We have recently had a number of clients who have realised that sooner is better when it comes to looking at their estate and have engaged us to perform a full IHT review.

An Inheritance Tax Review

An IHT review serves several purposes, but primarily acts as a sort of financial health check, looking at the position if the client (and their spouse or civil partner, if they have one) suddenly died. So, for example, we would look at the wills, any previous gifts and the assets owned by each person and determine what the financial impact of death looks like.

Invariably, the review throws up opportunities to improve the position, often significantly. It not only summarises the current position but also suggests changes which can make both immediate and longer-term savings to the position.

An example of improvements highlighted by an IHT review

The Nil Rate Band (NRB) and the Residence Nil Rate Band (RNRB)

By way of reminder, everyone gets a Nil Rate Band (NRB) of £325,000 to be used against any assets in their estate.

Where one spouse or civil partner has not used their full NRB, the unused portion can be transferred to the surviving partner. Where there is a family home in the estate being left to the children then there is an additional Residence Nil Rate Band (RNRB) of £175,000 each, and again if one spouse or civil partner does not use their full allowance then the unused portion can be transferred to the surviving partner. In practical terms, this means that for most married couples or civil partners who own their family home there are £1 million of tax-free allowances to use before any IHT becomes payable.

Here is a worked example

Suppose Mr and Mrs Bates have a house worth £1m owned between them and they each have other assets of £750k (often a combination of other properties, share portfolios, bonds, cash etc). Their wills are very typical and leave their whole estate to each other on the first death, and on the second death leave the assets to their children.

Let us assume Mr Bates dies first. His estate (being half of the house, worth £500k, and his other assets, worth £750k) will pass to Mrs Bates under his will. No IHT will be due on his death as his estate is inherited by his spouse and so is exempt. Mrs Bates’ estate is now worth £2.5m. On her death, she will be entitled to her Nil Rate Band (£325,000) and the unused Nil Rate Band from Mr Bates (another £325,000). She will also be entitled to some Residence Nil Rate Band (RNRB) to use against the house.

However, the RNRB is reduced where the total value of the estate exceeds £2m, and the RNRB is reduced by £1 for every £2 that the estate exceeds £2m. As Mrs Bates’ estate is worth £2.5m then the RNRB will be reduced by £250,000, meaning that of the total possible RNRB of £350,000 (i.e., £175,000 x 2), only £100,000 will be available.

Mrs Bates’s IHT calculation therefore looks like this:

| Total estate | £2,500,000 |

| Less NRB (Mrs Bates) | (£325,000) |

| Less NRB (unused from Mr Bates) | (£325,000) |

| Less RNRB (restricted to £100,000) | (£100,000) |

| Taxable estate | £1,750,000 |

| IHT at 40% | £700,000 |

However, if Mr & Mrs Bates had undertaken an IHT review in good time, this loss of the RNRB could have been mitigated.

Had Mr Bates’ will been changed so that his half of the house was given directly to the children then on his death £500,000 would have passed to his children IHT free, as £325,000 would be covered by his NRB and £175,000 covered by the RNRB.

Mrs Bates would then inherit the remaining £750,000, making her estate £2m. Her calculation would now look like this:

| Total estate | £2,000,000 |

| Less NRB (Mrs Bates) | (£325,000) |

| Less RNRB | (£175,000) |

| Taxable estate | £1,500,000 |

| IHT at 40% | £600,000 |

So, with a simple amendment to the will, the family would have saved £100k in IHT, by ensuring that full Residence Nil Rate Band was available for each of them by keeping Mrs Bates’ estate to below £2m.

Had Mr & Mrs Bates invested in an early IHT review, the RNRB savings along with potentially many others, would have reduced the family’s Inheritance tax bill significantly.

In summary

Simply put, we all need to try to push IHT planning up the “to do” list. It is not as uncomfortable as you may think. Once we have gathered the facts, we will put together your IHT Review Report which will summarise everything for you and make suggested improvements. If you are happy with the suggestions, we will implement them for you.

If you think an IHT review would be useful, please contact Richard Coombs (richardc@batesweston.co.uk) or Craig Simpson (craigs@batesweston.co.uk), for an initial chat, without obligation or cost.

This guidance is generic in nature and does not constitute advice. You should take no action based upon it without consulting ourselves or your own professional advisor.

Related Articles: