Cassandra Graham, Senior Tax Manager at Bates Weston looks at how director shareholders can pay themselves tax efficiently, given the fallout from Covid-19.

During the difficult trading conditions many business owners currently face, it is worth reviewing tax efficient remuneration strategies and profit extraction methods. Most director shareholders of owner managed businesses traditionally choose to pay themselves a minimal monthly salary, bolstered by dividends paid from profits after corporation tax. On the whole, even though the differential rate of tax between salary and dividends is marginal, there is still an overall tax saving on this method of profit extraction.

The Coronavirus Job Retention Scheme provides limited support for director shareholders. It covers only the salary element of the remuneration for those who have been furloughed. Those who have remained active beyond performing their statutory duties may not have received any government support at all. Profits are likely to be depressed too, making the level of dividend that can be declared legally or that is commercially viable, lower than it would usually be. Given this, in the current circumstances, what remuneration options do company directors have?

Cassandra considers their position.

“Under normal trading conditions, a low salary/high dividend strategy is adopted by many. However, it may be that until trading performance is certain declaring dividends will be avoided. As an alternative, provided cash flow allows, funds can be taken out of the company by way of a loan. This results in an overdrawn directors’ loan account but the tax implications of this should not be overlooked. If the loan remains outstanding nine months after the year end, the company will have to pay section 455 tax on the loan amount (32.5%) and if the loan is provided without the company charging interest, the resulting loan benefit in kind results in an income tax charge for the director and a Class 1A NIC charge for the company. However, this may be a useful way of buying yourself time to see how performance is impacted by the current crisis without risking the declaration of unlawful dividends. The loan can then be cleared through a later dividend payment, when your trading position is certain or alternatively written off. Once the loan is cleared the s455 tax paid will be refunded to the company, although it will only be paid nine months after the end of the accounting period in which the loan is cleared and therefore, from a cashflow perspective, there may be quite a wait until the money comes back from HMRC.”

Not only is this a time to consider how to manage your finances in the immediate future, it is also an opportune moment to look at future proofing your business to protect your financial position in the months and years to come.

Cassandra suggests considering the role that spouses and other family members play in your business. Now may be the time to consider family succession and how family members can be remunerated tax efficiently to bring a degree of protection to your family’s financial position. As shareholders for example, each would benefit from the £2,000 dividend allowance and dividend taxation rates but the transfer of shares to family members has tax implications in itself that need to be considered. The use of trusts can also be used as part of family shareholding arrangements, including considering interest in possession trusts to declare income directly to second generations.

In addition, methods of remuneration such as employer pension contributions being made by the company are simple but effective, as it is a tax-free benefit for the director and corporation tax deductible. Also, even though company cars provided are usually considered as an expensive luxury with high company car benefit tax charges, in the age of electric cars this results in a cheaper car benefit with negligible personal tax implications for the director and 100% corporation relief in the form of first-year allowances (FYAs) for the company.

Contact us today, without obligation, to review your director and shareholder remuneration plans and to consider your options .

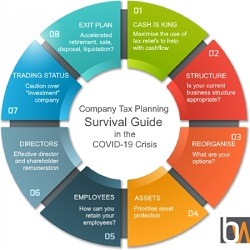

Cassandra considers the topic of tax efficient director and shareholder remuneration as part of Bates Weston’s Company Tax Planning Survival Guide. The guide considers 8 key aspects of tax planning that could help businesses get through the Covid-19 crisis. If you would like discuss any aspect of our Company Tax Planning Guide, please do get in touch with Cassandra Graham, Craig Simpson or Richard Coombs.

Disclaimer: The information contained in this article is generic in nature. You should take no action based upon it without consulting ourselves or an alternative professional advisor. All information correct at time of publication: 28 July 2020