Payroll Guidance

An update on the latest payroll guidance, including Employment Allowance, the King’s Coronation, Holiday Pay, National Minimum Wage and statutory rate changes.

An update on the latest payroll guidance, including Employment Allowance, the King’s Coronation, Holiday Pay, National Minimum Wage and statutory rate changes.

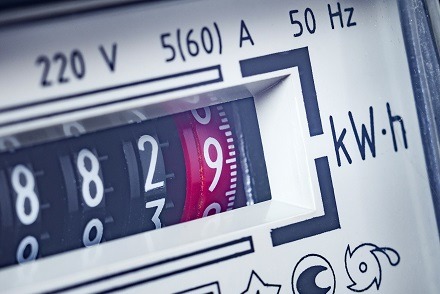

A recap of the Energy Bill Relief Scheme, making it clear that the discount only applies to the wholesale element of a business’ energy costs.

Craig Simpson, Tax Partner at Bates Weston looks at the growing trend towards employee Ownership and the Employee Ownership Trust in particular.

What are your options when selling your company? Discuss Trade Sale, Management Buyout, Family Buyout or an Employee Ownership Trust as possible exit routes with your tax advisor as early as you can.

Craig Simpson , Tax partner at Bates Weston, looks at the recommendations made by the OTS’ first report on the Capital Gains Tax review requested by the Chancellor.