News

A round up of our latest blogs, commentary or office news. Get in touch if you need more details on any of the topics covered.

Latest posts

Bates Weston advises on sale of Derbyshire logistics group

Bates Weston Corporate Finance team have advised on the sale of Silver X group and Bow Distribution and Warehousing to GBA Logistics.

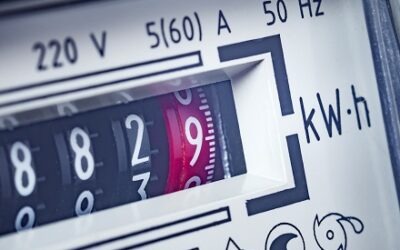

Increasing interest rates on overdue tax

The impact of rising interest rates on overdue tax charges, particularly costs associated with late payment of tax and paying Corporation Tax by instalments.

What is a holding company?

Craig Simpson, Tax Partner at Bates Weston, provides a brief guide to the holding company, including its purpose and how to put one in place.

Profit Extraction

What do the changing tax rates and allowances announced in the November 2022 Budget mean for profit extraction from your company?

Summary of Autumn Statement 2022

Summary report on the Autumn Statement delivered by the Chancellor 17 November 2022

Autumn Statement 17 Nov 2022

The headline tax rises the Chancellor announced in his Autumn Statement to Parliament on 17 Nov 2022

A recap of the Energy Bill Relief Scheme

A recap of the Energy Bill Relief Scheme, making it clear that the discount only applies to the wholesale element of a business’ energy costs.

Employee Ownership Trusts

Craig Simpson, Tax Partner at Bates Weston looks at the growing trend towards employee Ownership and the Employee Ownership Trust in particular.

Jeremy Hunt’s Statement 17 Oct 2022

In Jeremy Hunt’s statement yesterday, he told us which Mini-Budget measures are staying and which are not going ahead. The summary is simple. Everything goes except abolishing the Health & Social Care Levy, changes to Stamp Duty and the increased Annual Investment Allowance.

Update to Mini Budget October 2022

In an update to the mini budget, the Chancellor has cancelled his plans to abolish the higher 45% rate of Income Tax. We have update our Mini Budget Summary Report to reflect this.

Mini Budget 23 September 2022

The Chancellor has announced the Government’s growth plan and the tax measures that are included within it, in his mini budget. Here are the headlines.

Bates Weston Corporate Finance team advises on the sale of CPS Building Services

Chris Jones, Corporate Finance Partner at Bates Weston comments on the successful sale of CPS Building Services to H.I.G Capital.

Is a two year energy freeze on the way?

Is Liz Truss about to announce a two year freeze on energy costs?