What practical help do you expect from your accountants?

We are told that up to 40% of businesses have not heard from their accountant during the Covid-19 outbreak. At a time when we are more needed than ever, we find that astonishing and it’s certainly not true of Bates Weston.

Right now, amid media speculation about easing some lockdown measures and business calls for a safe and phased restart to the economy, we continue to focus on the practical help we can give our clients today.

We are:

- calculating employee pay under the furlough scheme

- making claims on behalf of clients under the Coronavirus Job Retention Scheme

- continuing to run payrolls for clients

- asking clients to defer VAT and Self-Assessment tax payments

- asking clients to make sure they have accessed relevant government grant funding

- helping clients to consider and apply for loans or overdraft facilities

- helping clients with practical tips on cashflow management

- helping clients prepare for Self-Employment Income Support claims

- preparing management accounts, VAT returns and annual accounts for clients

- continuing to work remotely on audit assignments

- forecasting cashflows and running “what if” scenarios

- keeping them as informed as possible about the changes that affect them

In short, we are doing all we can to help our clients cope with a very challenging economic climate. Like many of them, we are an SME ourselves, so we too are experiencing the same challenges first-hand.

Wayne Thomas comments:

“To feel that we are making a difference to our clients, is one silver lining from this difficult time. Another is the way our team has come together to tackle the challenges of working from home effectively and to respond and adapt to an entirely new set of government support schemes. No one, including us, had really heard of furloughing before 17 March, and here we are successfully making claims for clients who we also helped to adopt the scheme. Going forward, we will continue to identify problems, adapt our processes, manage our business and engage our team.

As yet, we have no clear understanding on what the government is planning for the next stage of the lockdown. It may involve a staggered return to work and phased adjustments to the government support schemes – we will not know until the official announcements are made. What we do know, is that whatever is thrown at us, we will pick it up, adapt and run with it and we will be helping our clients to do the same.”

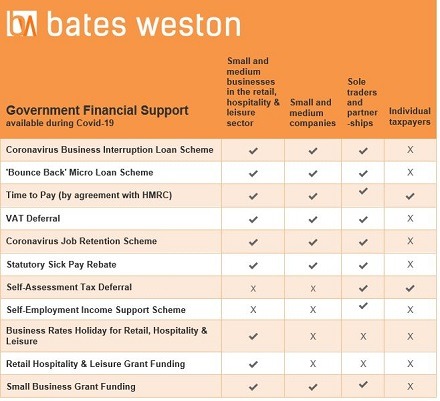

Below is a summary of the current government support available to businesses in England. If you need to talk through your options, or would like our help with any aspect of the government support available, please do get in touch.

Useful links

Bates Weston Covid-19 Business Support Page

Gov.uk coronavirus Business Support pages