Our experienced tax team could quite literally write a book on tax planning – so that’s exactly what they did when they were asked to be authors of Tolley’s Tax Planning for Owner Managed Businesses 2020/21.

We have advised business owners on all aspects of tax planning over the years, specialising in complex reorganisations and reconstructions arising from a decision to sell, divergence of shareholder plans, a change of strategic direction or protecting tax status.

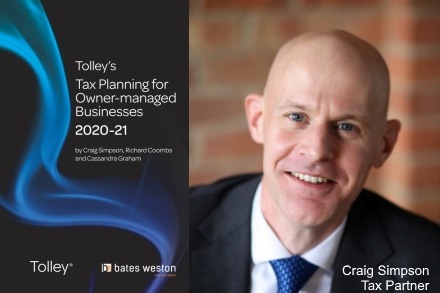

Putting this knowledge to good effect, our tax team led by Craig Simpson and co-authored by colleagues Richard Coombs and Cassandra Graham, took on the title. The book is part of the Tolley’s Tax Planning Series. Tolley’s are the UK market leader in providing practical tax and accountancy guidance, in-depth reference materials, exam training and exclusive market insights.

The book provides real life solutions on tax planning problems faced by business owners and is primarily a technical reference book for accountants, professional advisors and students.

It covers the key issues business owners face throughout the business lifecycle, looking at the tax planning opportunities in each transaction or event, using worked examples and case studies to explain tax liabilities, compliance and planning opportunities.

Craig Simpson, Tax partner at Bates Weston comments:

“We are delighted that our tax team has been able to draw on their extensive experience to take on this title. It reflects and enhances their growing reputation as tax advisors to substantial privately owned businesses and high net worth individuals and families. This year, perhaps more than ever, clients have needed our help.”

In a year which saw Bates Weston expand its tax team, Craig Simpson looks at the help we have given to owner managers in particular:

“Most owner managers expect tax planning to help them in the long term but during 2020 a large focus has been on structure and tax cashflows and we have helped owners recover cash from HMRC to assist with cashflow.

Covid-19 has prompted many business owners to review their business structure and longer-term plans. There may be are advantages to splitting up a company, separating the higher risk elements from those that are performing well or separating investment activities from trade. But it has to be done carefully, involving expert tax advice to avoid triggering unexpected tax liabilities.

Business owners may want to protect the cash, property and assets built up within a business – without triggering unnecessary tax, find ways to attract and keep key people when cash incentives may not be an option, pay director/shareholders tax efficiently, or plan their exit from the business. All of these goals involve exploring options fully with professional tax advisors like ourselves.”

If you are an accountant requiring high level tax planning services for your clients, we can work with you, on a non compete basis. Please do get in touch. If you are an owner manager and would like to discuss any aspect of tax planning , without obligation, again please do get in touch with Craig Simpson or Richard Coombs.

Disclaimer: The information contained in this article is generic in nature. You should take no action based upon it without consulting ourselves or an alternative professional advisor. All information correct at time of publication: 15 December 2020.