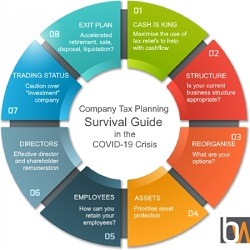

Given the unpredictable and often difficult trading conditions during the pandemic, many business owners are considering their longer-term plans, in particular their business exit planning.

They may have had a planned date by which they hoped to exit their business. They may have thought to sell to a third party, encourage a Management Buy Out, pass their shares on to a family successor, or be bought out by continuing shareholders. Whatever their plans had been, the substantial effects of Covid may well have caused them to rethink their plans.

Add to this, the Chancellor’s announcement to review the way in which Capital Gains Tax works and you have a sense of the quandary business owners find themselves in.

Our point is simple. Whether you fear your business may not survive to your planned exit date or that it will lose the value you have built up in it, or views on the outlook of your business differ among your existing shareholders, do not put off the difficult conversations. Have them with seasoned tax advisors alongside.

Cassandra Graham, Senior Tax Manager at Bates Weston reiterates the point:

“As a business owner, your business is fundamental to your own and your dependents’ lives. Decisions regarding its future are far reaching. Take them after exploring your options with professional tax advisors.”

In the last part of our Company Tax Planning Guide, Cassandra touches on four possible exit routes affected by Covid-19.

Accelerating retirement

An external sale may be less likely, but has the current situation made you think about accelerating your retirement plans? Management Buy-Outs or a company purchase of own shares may provide tax efficient solutions for an exit where third party sales are impossible. The structure here will be key to ensuring the transaction is one subject to capital gains tax not income tax.

Liquidation

There may be an option to formally liquidate your business and access Business Asset Disposal Relief (formerly Entrepreneurs’ Relief) and the 10% rate of capital gains tax on the capital disposal (now limited to £1M). However, this relief would only be available if there is no intention to carry on the same or similar activities within 2 years, otherwise the ‘anti-phoenixing’ antiavoidance regulations could result in an unforeseen income tax bill.

Take your time

Where third party sales are happening, we’re seeing an increase in the drive towards fast completion but in the rush to get the deal done tax advice should never be overlooked. It is crucial to ensure the drafting of the Sale and Purchase Agreement and structure of consideration are appropriate otherwise you could be paying thousands more in tax.

Access available reliefs

Finally, if the worst is to happen and companies collapse or loans become irrecoverable, there are tax reliefs available such as share loss relief, the corporate rescue exemption and relief for loans to traders that shouldn’t be forgotten as they provide the silver lining to the cloud.

If you would like to discuss your options, please do get in touch with Cassandra Graham.

You can see our full Company Tax Planning Guide here together with our previous blogs on these topics.

Keep a watchful eye on trading status

Strategies to pay director shareholders

Tax planning, share incentives and employee retention

Tax planning and asset protection

Merger, demerger and reorganisation

Company tax planning and business structure

How can company tax planning help with cashflow

If you would like to discuss any aspect of our Tax Planning Guide, please do get in touch with in touch with Cassandra Graham, Craig Simpson or Richard Coombs.

Disclaimer: The information contained in this article is generic in nature. You should take no action based upon it without consulting ourselves or an alternative professional advisor. All information correct at time of publication: 2 September 2020