Budget 2021 predictions

Balancing paying the £400 billion Covid bill versus stimulating consumer demand and business investment. The Budget 2021 predictions are caught in the same dilemma.

Balancing paying the £400 billion Covid bill versus stimulating consumer demand and business investment. The Budget 2021 predictions are caught in the same dilemma.

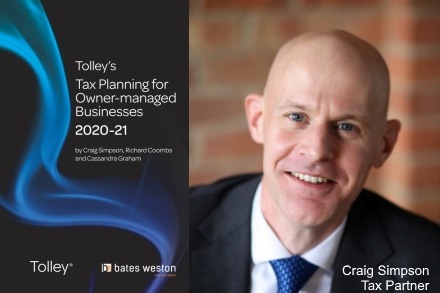

Following Rishi Sunak’s economic statement to the House of Commons on 11 Jan 2021, Craig Simpson, tax partner at Bates Weston, looks at the tax changes that may be ahead in the Budget on 3 March 2021.

Bates Weston’s tax team update and co-author Tolley’s Tax Planning for Owner Managed Businesses 2020-21.

Government review of R& D tax relief indicates that the relief does promote R & D spending but that 51% of companies have never heard of it. Richard Coombs takes a look at the findings.

Craig Simpson , Tax partner at Bates Weston, looks at the recommendations made by the OTS’ first report on the Capital Gains Tax review requested by the Chancellor.